Roth conversion calculator fidelity

The Mega Backdoor Roth 401k is one of the best employee benefits available to Microsoft employees. If your job offers an in-plan conversion you can convert all or some of your 401k into a Roth.

Salary calculator rank.

. Eligible Fidelity account with 50 or more. Where Fidelity falls short Higher fees for some of the mutual funds. Company Salaries has salaries data from over 200000 companies.

However all other mutual funds attract a 4995 fee per trade. As with Traditional IRA conversions to Roth IRAs if you are required to take an RMD in the year you roll over into an IRA you must take it before rolling over your assets. Protect Your Employee Benefit Plan With an ERISA Fidelity Bond Page 4.

Baca Juga

WealthTrace adjusts to changing data in real time. This video explains how the Microsoft Mega Backdoor Roth Conversion works and highlights whats new in. This is no ordinary retirement calculator.

151 million W-2s pay scale statistics in US. Use code FIDELITY100. These changes will offer you increased flexibility and greater convenience when managing your retirement plan accounts at Fidelity andor TIAA.

Not all employers offer in-plan conversions and even when they do a Roth 401k lacks a. Remember that Roth IRA contributions are limited based on income thresholds. The assets are transferred into an Inherited Roth IRA held in your name.

RMD for Current Year. 85 million company. Converting to a Roth IRA may ultimately help you save money on income taxes.

Note also if you have assets in a Designated Roth Account ie Roth 401k and would like to roll these to an IRA the assets must be rolled into a Roth IRA. The accounts are funded with after-tax dollars and so do not offer the upfront tax break of a 401k or traditional IRA. Since it can be purchased in large amounts for a relatively small initial premium it is well suited for short-range goals such as coverage to pay off a loan or providing extra protection during the.

401k Spend it or Save It Calculator. Contribute to your companys Roth 401k if offered by your employer or do an in-plan conversion to a Roth 401k. A backdoor Roth IRA is a type of conversion that allows people with high incomes to fund a Roth despite IRS income limits.

You have to pay taxes on the amount you convert but like with a Roth IRA. The changes to investment fund choices were the result of an 8-month review of the current 200 investment choices allowed in the University of Nebraskas retirement savings plans. Salary Map helps you navigate location based salary information.

State. Our retirement planning software allows users to run Monte Carlo simulations and what-if scenarios on market downturns life insurance retirement income and Roth conversions. Higher pricing with robo advisor competitors.

Money is available At any time up until 1231 of the tenth year after the year in which the account holder died at which point all assets need to be fully distributed. We want to help you understand how this benefit can help you invest more towards retirement and reduce some of your future tax liabilities. Roth IRAs are similar to traditional IRAs but are taxed differently.

Traditional 401k Solo 401k Analysis. 29 CFR 2580412-6 - Determining When Funds or Other Property Are Handled so As to Require Bonding. Term life insurance provides death protection for a stated time period or term.

Of all the mutual funds available for investing in Fidelity Roth IRA only 4 of these funds have zero-commissions. For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account. An allowable nondeductible contribution can be made to a traditional IRA and then a Roth Conversion can be executed.

A backdoor Roth is a strategy that has been adopted as a workaround if you should find yourself in this situation. However you may consider 2 options.

Converting Ira To Roth Ira Fidelity

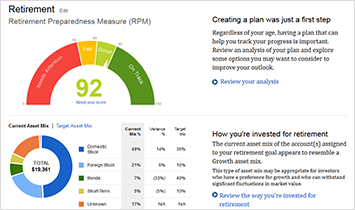

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Traditional Vs Roth Ira Calculator

Understanding The Mega Backdoor Roth Ira

Roth Conversion Calculator Fidelity Investments

Listing Of All Tools Calculators Fidelity

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

2

Ira Calculator Roth Flash Sales 60 Off Www Wtashows Com

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

6 Best Roth Iras Of 2022 Forbes Advisor

Roth Ira Fidelity Review Best Retirement Account 2022

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

Converting Ira To Roth Ira Fidelity

Roth Ira Conversions When Why And How To Convert A Traditional Ira To A Roth Ira Seeking Alpha

Spaxx Vs Fdic Vs Fdrxx Best Fidelity Core Position Personal Finance Club

Listing Of All Tools Calculators Fidelity